The Confusion Of The Oil Barrons

It is a truth universally acknowledged, though rarely admitted aloud, that men who purchase presidents expect a certain courtesy in return. Not affection, perhaps, but at least the dignity of being consulted before their investment is detonated in public.

Thus, it has come as a considerable shock to America’s fossil fuel benefactors to discover that the President they so generously sponsored now proposes to personally seize a foreign nation’s oil, flood the global market, collapse prices, and then look his donors in the eye and ask why they appear to be “playing too cute.”

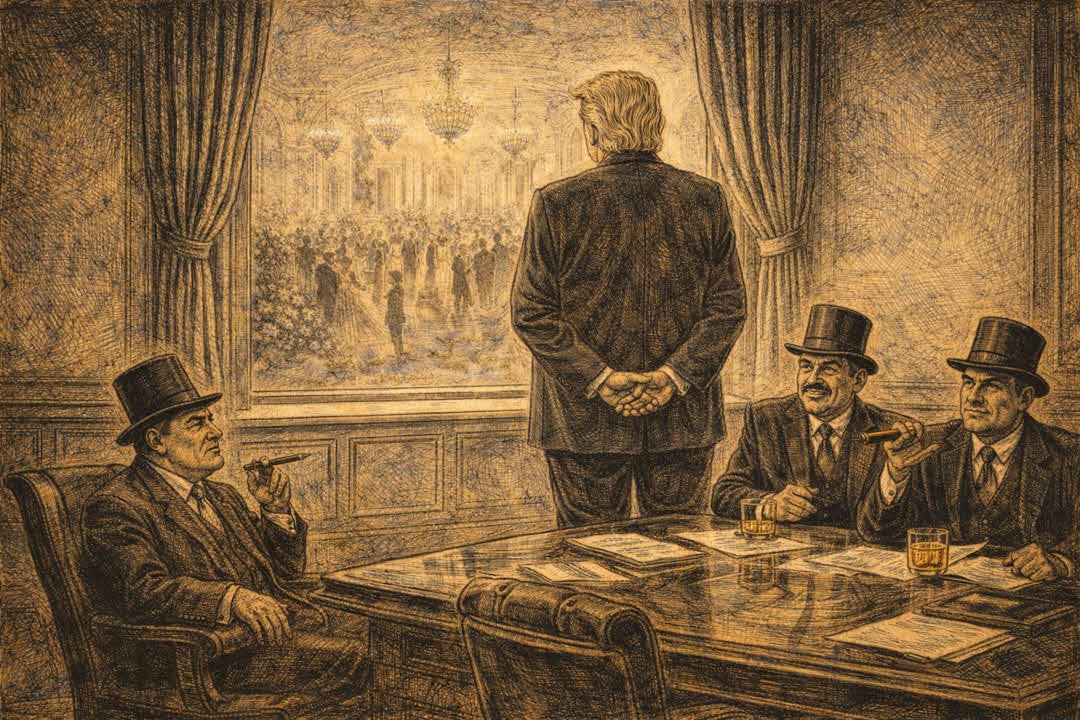

He meets with them at the White House, but he is thinking about his grand ballroom. He even looks out the window and imagines the grandness of his ballroom.

Donald Trump gazes out the window as he imagines his ballroom. The oil barons look on.

One can hardly blame them for their confusion. They were promised deregulation, indulgence, and the quiet assurance that profits would be protected like an endangered species. Instead, they find themselves watching a septuagenarian property developer announce, without any visible irony, that he will personally control the revenue of another country’s oil as if it were a midtown parking garage.

The donors, it seems, mistook corruption for competence. This is an egregious error indeed.

The President, having learned that oil executives dislike low oil prices (a niche preference, to be sure), has responded not with reflection but with vengeance. When Exxon politely observed that Venezuela was “uninvestable” (read the full statement by Darren Woods), citing the minor inconvenience of having its assets seized twice, the President reportedly threatened to exclude the company altogether—an act of statesmanship roughly equivalent to banning a surgeon for mentioning we need to prevent an infection.

This is the new doctrine of energy policy: loyalty over literacy, enthusiasm over arithmetic.

Meanwhile, smaller shale producers, those patriotic independents who mortgaged democracy for drilling rights, are discovering the joys of market glut. Oil prices sink. Rigs idle. And executives who once toasted “energy dominance” now learn that dominance, like gravity, applies downward first.

They are angry not because the plan is immoral, illegal, or destabilizing. Rather, they are angry because it is being done to them.

Their outrage is certainly touching.

The fossil fuel industry spent hundreds of millions ensuring this administration’s return, having been assured, privately and explicitly, that regulations would be erased on command. What they failed to factor into their spreadsheets was the President’s belief that ownership is more satisfying than partnership, and that applause matters more than outcomes.

Thus, Venezuela becomes not a country but a stage. Oil ceases to be a commodity and becomes a prop. And donors become supporting actors in a production where the lead insists on personally controlling the box office receipts.

Behind closed doors, executives mock him while publicly nodding in mock agreement. They will string him along, promise an investment “soon,” and, in reality, it will never arrive. This is because serious capital dislikes volatility, and nothing is more volatile than a man who thinks geopolitics is a real estate deal with flags.

The misfortune here is not that fossil fuel donors are unhappy. It is that they are surprised.

They purchased access, not foresight. They funded spectacle, not stability. And now they are learning a lesson long familiar to anyone who has ever dealt with a con artist: once you may be useful, but you are also disposable.

In the end, the oil may flow, the prices may crash, and the donors may lose fortunes. Still, keep in mind that the President retains what he prizes above all: attention, accolades, and an unwavering belief that any ridicule behind his back merely confirms his superiority.

History does not issue refunds.